Unlocking Growth and Stability: The Power of in Modern Business

In today’s rapidly evolving commercial landscape, businesses must navigate complex risks, regulatory challenges, and market fluctuations. One of the pillars supporting business resilience and growth is a robust insurance partner. Associated industries insurance co has emerged as a trusted ally, providing specialized coverage and innovative risk management solutions specifically designed to meet the needs of diverse industrial sectors.

Understanding the Role of Associated Industries Insurance Co: A Strategic Asset for Businesses

At its core, associated industries insurance co operates as a specialized insurer, focusing on delivering comprehensive insurance policies tailored to various industrial and commercial sectors. Their expertise extends beyond traditional coverage, incorporating industry-specific risks, regulatory compliance, and emerging threats such as cyber-attacks and environmental hazards.

The Evolution of Business Insurance and the Rise of Sector-Specific Providers

Over the past few decades, the insurance industry has undergone significant transformations. The move toward specialization stems from the recognition that different industries face unique risks requiring targeted solutions. Associated industries insurance co embodies this trend, leveraging industry insights and data analytics to craft policies that provide more precise coverage and superior risk mitigation strategies.

Core Offerings of Associated Industries Insurance Co: Tailored Solutions for Varied Sectors

- Property and Casualty Insurance: Protects industrial facilities, manufacturing plants, and commercial properties against damages, theft, and liability claims.

- Liability Coverage: Covers legal liabilities arising from accidents, environmental impact, or product defects, crucial for industries with high exposure to litigation risks.

- Worker’s Compensation and Employee Benefits: Ensures business compliance with workplace safety regulations while safeguarding employee wellbeing.

- Professional Liability Insurance: Tailored for consulting firms, engineers, and technical service providers to shield against operational errors and omissions.

- Cyber Insurance: Addresses threats related to data breaches, cyber-attacks, and online operational disruptions, increasingly vital in the digital age.

- Environmental Liability: Focuses on risks associated with pollution, waste management, and environmental compliance—significant concerns for manufacturing and industrial sectors.

Why Businesses Choose Associated Industries Insurance Co: Key Benefits and Competitive Advantages

1. Industry-Specific Expertise and Customized Coverage

One of the primary reasons companies partner with associated industries insurance co is their deep industry knowledge. They understand the nuances of each sector, enabling them to develop tailored policies that cover specific risks, reduce exposure, and optimize coverage costs.

2. Innovative Risk Management Strategies

Beyond mere insurance policies, associated industries insurance co offers consultation on preventive measures and loss control. This proactive approach minimizes incidents before they occur, saving businesses money and safeguarding reputation.

3. Access to Advanced Data Analytics and Technology

Utilizing cutting-edge data analytics, artificial intelligence, and machine learning, associated industries insurance co accurately assesses risks, forecasts potential threats, and streamlines claims processing, resulting in faster service and better policy management.

4. Strong Financial Stability and Trustworthiness

Business owners seek insurance providers with a solid financial foundation. Associated industries insurance co maintains rigorous financial standards, ensuring claim payments are timely and claims handling is transparent and fair.

5. Commitment to Regulatory Compliance and Ethical Practices

Operating within complex legal frameworks, associated industries insurance co keeps businesses compliant with industry standards, environmental regulations, and safety protocols, thereby reducing legal risks and penalties.

Key Sectors Benefiting from Associated Industries Insurance Co Coverage

Manufacturing and Industrial Sector

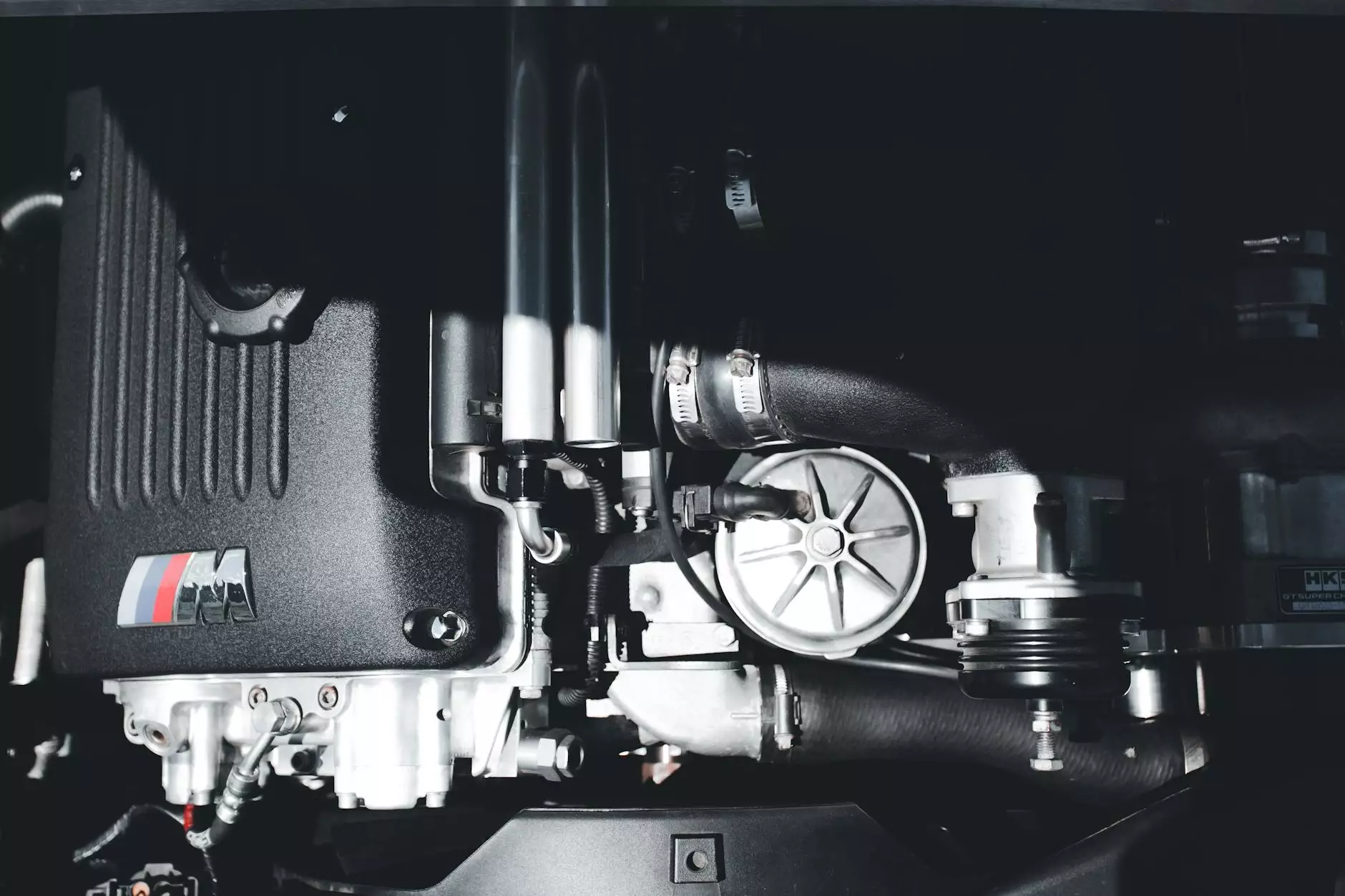

This industry faces risks from equipment breakdowns, workplace injuries, environmental impacts, and supply chain disruptions. Associated industries insurance co provides comprehensive policies that protect manufacturing assets, ensure worker safety, and maintain operational continuity.

Construction and Infrastructure

Construction projects involve high liability exposure, heavy equipment, and project delays. The tailored insurance solutions protect against property damage, contractor liability, and project delays, ensuring smooth project execution.

Technology and Cyber-Related Risks

Digital transformation introduces cyber threats that can cripple business operations. The specialized cyber insurance policies from associated industries insurance co provide crucial protection against data breaches, cyber extortion, and online operational risks.

Environmental and Waste Management Industries

These sectors are subject to stringent environmental laws and increasing liability risks. The insurance offerings include pollution liability, cleanup costs, and environmental disaster coverage, helping companies comply and mitigate financial impacts of environmental incidents.

How to Choose the Right Insurance Partner: Key Considerations

Assess Industry Knowledge and Experience

Ensure your insurance provider has proven expertise in your specific sector. This solid understanding translates into more accurate risk assessment and tailored coverage.

Evaluate Financial Stability and Claims Service

Review financial ratings from agencies like A.M. Best or Standard & Poor’s to confirm strength. Additionally, examine their claims processing efficiency and customer testimonials.

Consider Innovation and Technology Integration

Partner with companies that leverage modern technology for risk assessment, policy management, and claims handling for faster and more transparent service.

Review Policy Customization Options

Opt for flexible policies that can be tailored as your business evolves. A good insurance partner should provide customizable packages aligned with your specific business model and growth plans.

The Future of Business Insurance with Associated Industries Insurance Co

The landscape of business insurance is continuously transforming due to technological innovations, regulatory changes, and emerging global risks. Associated industries insurance co is at the forefront of this evolution, investing in:

- Advanced predictive analytics for proactive risk mitigation

- Expansion of cyber and environmental coverage options

- Integration of IoT devices for real-time risk monitoring

- Developing industry partnerships for holistic risk management

By embracing these advancements, associated industries insurance co ensures its clients are prepared for unexpected challenges and poised for sustained growth in a competitive marketplace.

Conclusion: Strengthening Your Business Foundation with Associated Industries Insurance Co

Choosing the right insurance provider is a critical decision that impacts your company's long-term stability, operational efficiency, and growth potential. Associated industries insurance co offers a comprehensive, industry-specific approach that helps businesses navigate complex risks, comply with evolving regulations, and seize new opportunities with confidence.

By partnering with a dedicated and innovative insurer like associated industries insurance co, your business gains a strategic ally committed to safeguarding your assets, optimizing your risk profile, and supporting your journey toward success. Whether you operate in manufacturing, construction, technology, or environmental sectors, specialist insurance solutions tailored through associated industries insurance co can be the key to unlocking your enterprise’s full potential.

Take Action Today

Investing in the right insurance coverage is more than a risk transfer mechanism—it’s a strategic move to position your business for resilience and growth. Explore aiin.com today to learn more about tailored insurance solutions engineered for your industry and stay ahead in an increasingly competitive environment.